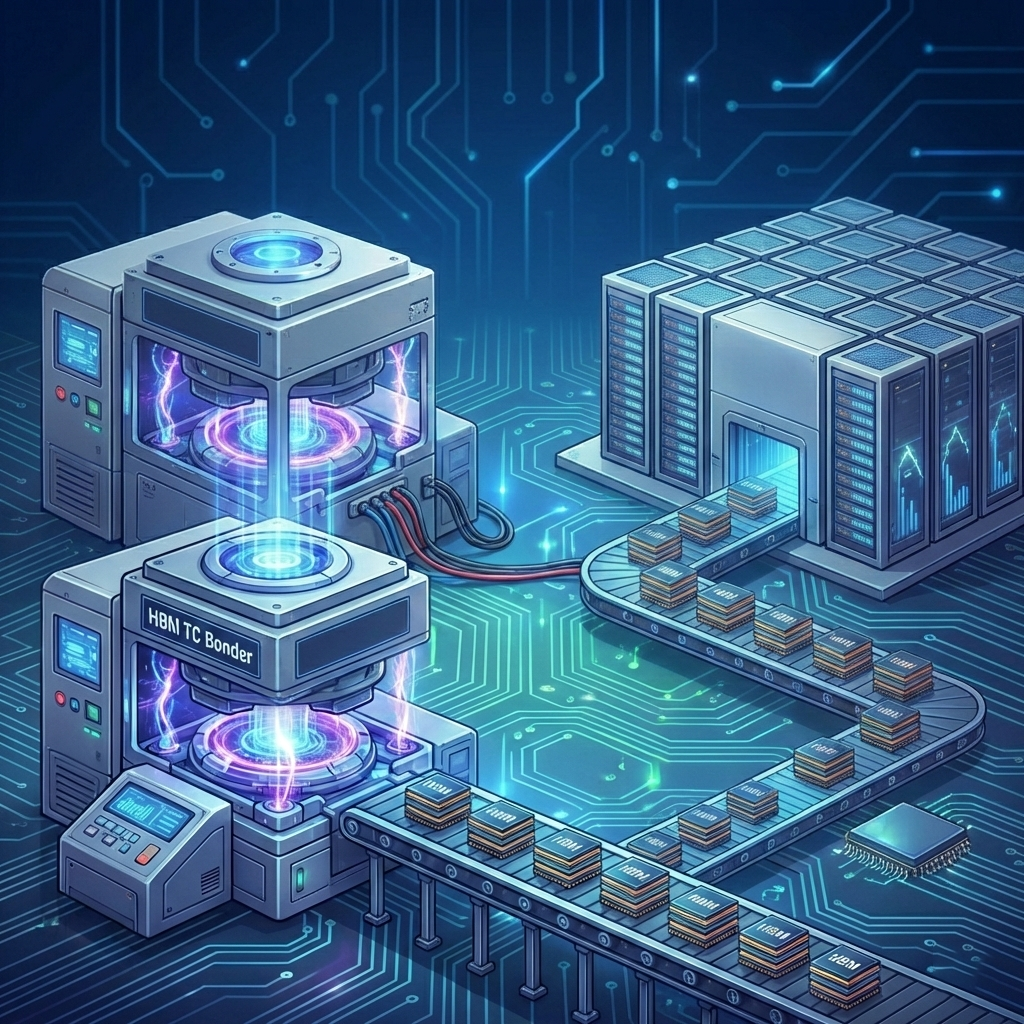

SK Hynix’s Strategic HBM Push and the Pivotal Role of TC Bonders

In the fiercely competitive landscape of high-bandwidth memory (HBM) production, SK Hynix is making significant strategic moves to solidify its leadership, particularly evident in its recent multi-billion won investment in Thermal Compression (TC) bonder equipment. This crucial development, unfolding amidst a dynamic and often volatile Korean stock market, underscores the company’s aggressive pursuit of HBM market dominance and highlights the indispensable role of its key suppliers, most notably Hanmi Semiconductor.

Reports indicate that SK Hynix has initiated its HBM capital expenditure for the year by placing a substantial order for TC bonders, totaling approximately 20 billion Korean Won (KRW). This vital equipment, essential for stacking memory dies in HBM production, has been strategically awarded to two prominent South Korean manufacturers: Hanmi Semiconductor and Hanwha Semitec. Hanmi Semiconductor secured a significant portion of this contract, amounting to roughly 9.6 billion KRW, reaffirming its critical position in the advanced packaging ecosystem.

This particular contract holds added significance given past reports of alleged “disputes” between SK Hynix and Hanmi Semiconductor. These rumored tensions often revolved around supply chain diversification efforts by SK Hynix and price negotiations. The new order, therefore, not only signals a renewed vote of confidence in Hanmi Semiconductor’s technological capabilities but also suggests a successful resolution or mitigation of these prior commercial complexities, paving the way for a strengthened partnership in the HBM race. Moreover, SK Hynix is reportedly placing additional orders for existing HBM TC bonders from both Hanmi Semiconductor and Hanwha Semitec, indicating a broader scaling of production capacity.

The ability of these newly ordered TC bonders to handle next-generation HBM4 technology is a critical factor. With SK Hynix having already secured commitments to supply HBM4 to industry giants like NVIDIA, the performance and readiness of its manufacturing equipment are paramount. While both Hanmi Semiconductor and Hanwha Semitec are contributing, the depth of Hanmi Semiconductor’s technological prowess in this domain could potentially shape the competitive dynamics between the suppliers, especially concerning their influence on the crucial HBM4 supply chain.

Hanmi Semiconductor: Navigating Market Volatility Amidst Core Strength

Despite the unequivocal positive news of the SK Hynix contract, Hanmi Semiconductor’s stock performance on January 15, 2026, presented a nuanced picture. Early morning trading saw the stock experiencing slight declines, hovering around 1.07% down from its previous close at one point, and later showing a 0.45% decrease. This intraday fluctuation, occurring even after the pre-market announcement of a major supply contract, might initially seem counterintuitive.

However, market experts suggest this could be attributed to several factors inherent in the dynamic Korean market. Firstly, a classic “buy the rumor, sell the news” phenomenon might be at play, where investors who had anticipated such a contract and drove up the stock price in preceding days opted to realize profits upon the official announcement. Secondly, the broader market’s rapid sector rotation could have influenced short-term trading decisions. Nonetheless, Hanmi Semiconductor remained a highly searched and discussed stock, appearing prominently on various “most searched” lists, indicating sustained high investor interest and its perceived strategic importance.

The underlying strength of Hanmi Semiconductor lies in its foundational technology. As a leading provider of semiconductor equipment, particularly in advanced packaging solutions like TC bonders, the company is directly benefiting from the explosive growth of AI and high-performance computing, which are heavily reliant on HBM. The consistent demand from major memory manufacturers like SK Hynix underscores Hanmi Semiconductor’s technological edge and its irreplaceable role in the global semiconductor supply chain.

The Broader Market Context: A Breathless Cycle of Sector Rotation

The slightly volatile intraday performance of Hanmi Semiconductor also serves as a microcosm of the broader trends gripping the Korean stock market, often characterized by “breathless rotation.” The KOSPI, currently hovering around the 4700 mark, has been witnessing swift shifts in investor sentiment and capital allocation across various sectors. Just the day before, semiconductor giants like Samsung Electronics, SK Hynix, and Hanmi Semiconductor, alongside power and nuclear energy-related stocks such as Doosan Enerbility and HD Hyundai Electric, were leading the charge and bolstering the index. However, a mere 24 hours later, investor focus had dramatically shifted towards shipbuilding stocks, causing many of the previous day’s strong performers to lose momentum.

This rapid rotation, where yesterday’s darlings are quickly supplanted by new sector leaders, reflects a market grappling with a complex mix of global economic uncertainties, technological shifts, and domestic policy influences. Analysts point to a confluence of factors, including institutional investors rebalancing portfolios, speculative short-term trading based on news cycles, and varying government initiatives (e.g., discussions about boosting nuclear power utilization or potential reforms like the 3rd commercial law amendment aimed at reaching KOSPI 5000). For individual companies like Hanmi Semiconductor, this means that even robust fundamental news can be temporarily overshadowed by broader market currents and the fickle nature of investor sentiment, making a long-term perspective crucial for investors.

In essence, while the immediate stock reaction might seem muted, the strategic importance of SK Hynix’s investment in TC bonders and Hanmi Semiconductor’s central role remains undiminished. It signals a strong commitment by a major memory producer to ramp up HBM production, ensuring a sustained demand environment for critical equipment suppliers. As the global demand for AI-driven computing continues its upward trajectory, the foundations laid by these strategic partnerships and technological advancements will undoubtedly shape the future of high-tech manufacturing, regardless of short-term market fluctuations.

Leave a Reply

You must be logged in to post a comment.